How to Get Ozempic Covered by Insurance: Step-by-Step Guide

You’ve decided Ozempic is right for you, and now you’re facing the challenge of getting your insurance to cover it. Maybe your doctor submitted a prescription and it was denied, or you’re trying to understand what’s required before you even start the process. Insurance coverage for Ozempic can feel like navigating a maze of prior authorizations, medical necessity requirements, and confusing denial letters.

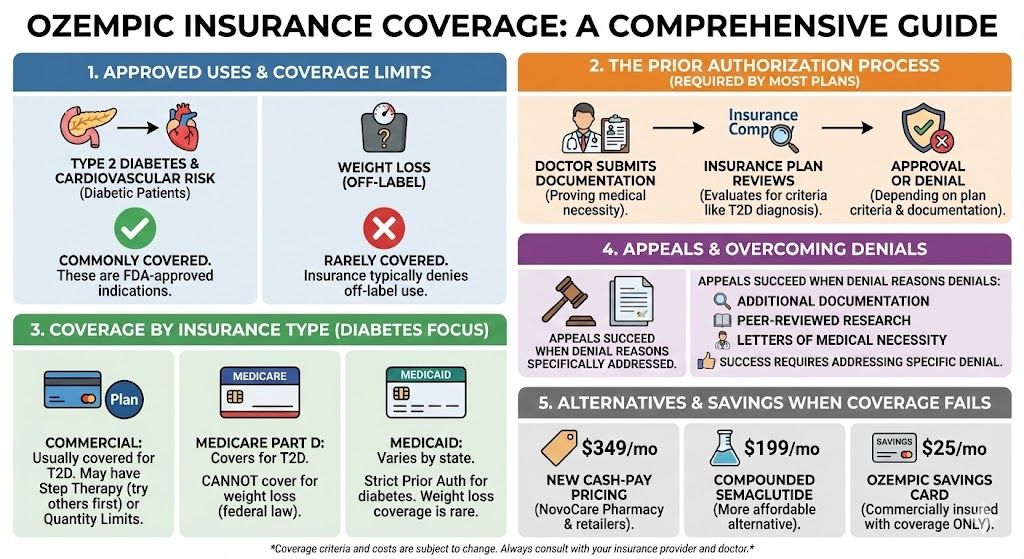

Here’s what you need to know: Ozempic insurance coverage depends primarily on why you’re taking it and what type of insurance you have. Most commercial insurance plans cover Ozempic for type 2 diabetes management after prior authorization, but coverage for off-label weight loss use is rare. Medicare Part D covers Ozempic for diabetes but is legally prohibited from covering weight loss medications. Getting coverage approved requires understanding your plan’s specific requirements, providing thorough documentation, and knowing how to appeal if initially denied.

This guide walks you through the complete process of getting Ozempic covered by insurance, including how to determine if your plan covers Ozempic, the prior authorization process step by step, documentation that improves approval chances, how to appeal denied claims successfully, what to do when coverage isn’t possible, and affordable alternatives when insurance won’t help.

Key Takeaways: Ozempic Insurance Coverage

- Ozempic is FDA-approved for type 2 diabetes and cardiovascular risk reduction in diabetic patients, which are the indications insurance will cover. Weight loss is off-label and rarely covered.

- Prior authorization is required by most insurance plans, meaning your doctor must submit documentation proving medical necessity before coverage is approved.

- Commercial insurance covers Ozempic for diabetes in most cases, though you may face step therapy requirements (trying other medications first) or quantity limits.

- Medicare Part D covers Ozempic for type 2 diabetes but cannot cover it for weight loss due to federal law prohibiting Medicare from covering weight loss medications.

- Medicaid coverage varies by state and typically requires extensive prior authorization for diabetes treatment. Weight loss coverage is rare.

- Appeals succeed most often when denial reasons are specifically addressed with additional documentation, peer-reviewed research, or letters of medical necessity from specialists.

- When insurance coverage fails, new cash-pay pricing at $349 monthly or compounded semaglutide at $199 monthly provide affordable alternatives.

- The Ozempic Savings Card can reduce costs to $25 monthly for commercially insured patients whose plans cover the medication.

Understanding What Insurance Covers

Before pursuing coverage, understand what insurance plans typically do and don’t cover regarding Ozempic.

FDA-Approved Indications (What Insurance Covers)

Ozempic is FDA-approved for two indications that insurance may cover:

Type 2 diabetes management: Ozempic is approved to improve blood sugar control in adults with type 2 diabetes, used alongside diet and exercise. This is the primary indication most insurance plans cover.

Cardiovascular risk reduction: Ozempic is approved to reduce the risk of major cardiovascular events (heart attack, stroke, cardiovascular death) in adults with type 2 diabetes and established cardiovascular disease.

If your doctor prescribes Ozempic for either of these reasons and you have documentation supporting the diagnosis, you have a reasonable chance of getting coverage with proper prior authorization.

Off-Label Use (What Insurance Rarely Covers)

Weight loss without diabetes: Ozempic is frequently prescribed off-label for weight management in patients who don’t have type 2 diabetes. However, most insurance plans explicitly exclude coverage for weight loss medications or require a diabetes diagnosis for Ozempic approval.

If you want Ozempic specifically for weight loss without a diabetes diagnosis, expect your insurance to deny coverage. In this case, consider asking your doctor about Wegovy (semaglutide approved for weight loss), which some plans cover for obesity treatment, or explore cash-pay options.

Why the Distinction Matters

Insurance companies base coverage decisions on FDA-approved indications. When your doctor writes a prescription, they include a diagnosis code (ICD-10 code) that tells the insurance company why you need the medication.

Prescription with diabetes diagnosis (E11.x codes): Likely to be considered for coverage Prescription with obesity diagnosis (E66.x codes): Likely to be denied unless your plan specifically covers weight loss medications

Your doctor’s diagnosis code selection significantly impacts whether your claim is approved or denied.

Step 1: Check Your Insurance Coverage

Before your doctor submits a prescription, determine whether your plan covers Ozempic.

Contact Your Insurance Company

Call the member services number on your insurance card. Ask specifically:

“Is Ozempic (semaglutide) on my plan’s formulary?” “What tier is Ozempic on?” (Higher tiers mean higher copays) “Is prior authorization required for Ozempic?” “What are the prior authorization requirements?” “Is Ozempic covered for type 2 diabetes? What about weight loss?” “Are there step therapy requirements?” (Must you try other medications first?) “What is my estimated out-of-pocket cost?”

Document the representative’s name, date, and reference number for your call. Request written confirmation of coverage details if possible.

Review Your Plan Documents

Your Summary of Benefits and Coverage (SBC) and formulary list provide written details about medication coverage.

Check the formulary: Most insurance companies publish their drug formularies online. Search for “semaglutide” or “Ozempic” to see if it’s listed and what tier it’s on.

Look for exclusions: Review any sections listing excluded medications. Some plans explicitly exclude GLP-1 medications, weight loss drugs, or specific brand names.

Understand cost-sharing: Identify your deductible, copay structure, and out-of-pocket maximum. Even if Ozempic is covered, you need to understand what you’ll pay.

Request a Test Claim

Ask your pharmacy to run a test claim before filling the prescription. This shows exactly what your insurance will cover and what you’ll owe, preventing surprises at the pharmacy counter.

A test claim reveals whether the medication is covered, what your cost-sharing amount would be, whether prior authorization is needed, and any quantity limits or restrictions.

Step 2: Understand Prior Authorization Requirements

Most insurance plans require prior authorization (PA) for Ozempic, meaning your doctor must get approval before the insurance will cover it.

What Prior Authorization Involves

Prior authorization is your insurance company’s process for verifying that a prescribed medication is medically necessary and meets their coverage criteria. Your doctor submits documentation, the insurance reviews it, and they approve or deny coverage.

The PA process exists because Ozempic is expensive (approximately $1,000 monthly at list price), alternative treatments may be preferred by your plan, and insurance companies want to ensure appropriate use.

Common Prior Authorization Requirements

Most plans require documentation of:

Confirmed type 2 diabetes diagnosis: Lab results showing HbA1c levels, fasting glucose tests, or other diagnostic criteria. A diagnosis code alone may not be sufficient; insurance often wants proof.

Current HbA1c level: Many plans require HbA1c above a certain threshold (commonly 7.0% or higher) to demonstrate inadequate blood sugar control.

Previous medication trials: Most plans require you’ve tried and failed (or have contraindications to) first-line diabetes medications like metformin. This is called “step therapy.”

Documentation of diet and exercise attempts: Some plans require evidence that lifestyle modifications have been attempted before approving medication.

Prescriber credentials: Some plans require prescription from an endocrinologist or diabetes specialist rather than a primary care physician.

Step Therapy Requirements

Step therapy means you must try less expensive medications before the insurance will cover Ozempic. Common step therapy requirements include:

Step 1: Metformin (must try for 3-6 months) Step 2: Another oral diabetes medication (sulfonylurea, SGLT2 inhibitor) Step 3: GLP-1 medication like Ozempic

If you’ve already tried these medications, document the dates, doses, and why they were inadequate (side effects, insufficient blood sugar control, etc.).

If you have medical reasons why you can’t take step therapy medications (allergies, contraindications, previous adverse reactions), document these as reasons for step therapy exception.

Step 3: Work With Your Doctor on Documentation

Strong documentation significantly improves approval chances. Work with your healthcare provider to compile comprehensive records.

Essential Documentation

Diagnosis confirmation: Lab results confirming type 2 diabetes diagnosis, including HbA1c levels, fasting glucose, and any other relevant tests.

Current disease status: Recent HbA1c showing inadequate control on current treatment. Many plans require HbA1c above 7.0% or 7.5%.

Medication history: Complete list of diabetes medications you’ve tried, including dates of use, doses, and outcomes. Document why each was discontinued (inadequate control, side effects, etc.).

Comorbidities: Documentation of weight-related health conditions (high blood pressure, high cholesterol, sleep apnea, cardiovascular disease) that support the need for additional treatment.

Body measurements: Current weight, BMI, and any documented weight changes over time.

Lifestyle documentation: Evidence of diet and exercise attempts, nutrition counseling, or participation in lifestyle programs.

Letter of Medical Necessity

A detailed letter from your doctor explaining why Ozempic is medically necessary for your specific situation strengthens your prior authorization request.

The letter should include your diagnosis and current disease status, treatments tried and why they were inadequate, specific reasons why Ozempic is the appropriate choice, clinical evidence supporting Ozempic for your condition, and potential health consequences if Ozempic is not approved.

Specialist Involvement

If your primary care doctor prescribes Ozempic but your plan requires specialist prescription, consider getting an endocrinology referral. Specialists can provide additional documentation and their expertise may carry more weight in appeals.

Step 4: Submit the Prior Authorization

With documentation prepared, your doctor’s office submits the prior authorization request.

Submission Process

Your doctor’s office typically handles PA submission. The process involves completing the insurance company’s prior authorization form, attaching required documentation, submitting via the insurance company’s preferred method (fax, online portal, phone), and tracking the request for response.

Ask your doctor’s office to provide you with the submission date and tracking information so you can follow up.

Response Timeframes

Standard requests: Insurance companies typically respond within 5-15 business days Urgent requests: If there’s a medical urgency, your doctor can request expedited review (typically 24-72 hours)

If you haven’t received a response within the expected timeframe, call your insurance company to check status.

Possible Outcomes

Approved: You can fill the prescription with your insurance coverage. Approvals are typically valid for 6-12 months before reauthorization is needed.

Denied: The insurance company determined the medication doesn’t meet their criteria. You’ll receive a denial letter explaining the reason. You have the right to appeal.

Partially approved: Coverage may be approved with restrictions (quantity limits, specific dose requirements, etc.).

More information requested: The insurance needs additional documentation before making a decision.

Step 5: Appeal a Denied Claim

If your prior authorization is denied, you have the right to appeal. Many denials are overturned on appeal, especially when additional documentation is provided.

Understanding Your Denial

Review the denial letter carefully. It must explain the specific reason for denial, your appeal rights and deadlines, and what additional information might change the decision.

Common denial reasons include step therapy not completed (haven’t tried required medications first), insufficient documentation (lab results or medical records not provided), not meeting clinical criteria (HbA1c not high enough, diagnosis not confirmed), off-label use not covered (prescribed for weight loss, not diabetes), and formulary exclusion (Ozempic not on your plan’s drug list).

Preparing Your Appeal

Address the specific denial reason. Your appeal should directly respond to why coverage was denied.

For step therapy denial: Provide documentation of previous medications tried, including dates, doses, and specific reasons they were inadequate. Include any medical reasons why step therapy medications are contraindicated.

For insufficient documentation: Gather the specific records requested. Include comprehensive lab results, medical history, and physician notes.

For clinical criteria denial: Provide additional evidence showing you meet criteria, or explain why criteria should be waived for your specific medical situation.

For off-label denial: If you have diabetes, ensure the prescription clearly indicates type 2 diabetes as the diagnosis. If you don’t have diabetes and want coverage for weight loss, this is unlikely to be overturned.

Strengthening Your Appeal

Include peer-reviewed research: Attach clinical studies supporting Ozempic’s effectiveness for your condition. The SUSTAIN clinical trial program provides extensive evidence for diabetes management.

Get a letter from a specialist: An endocrinologist’s letter explaining medical necessity carries weight in appeals.

Document potential consequences: Explain health risks if Ozempic is not approved (poor diabetes control, cardiovascular risks, etc.).

Request peer-to-peer review: Ask your doctor to speak directly with the insurance company’s medical director. Sometimes physician-to-physician conversation resolves issues.

Appeal Submission

Submit your appeal in writing within the deadline specified in your denial letter (typically 30-180 days). Include the denial letter reference number, all supporting documentation, a clear explanation of why the denial should be overturned, and your contact information.

Send via certified mail or confirmed fax to ensure receipt. Keep copies of everything submitted.

External Review

If your internal appeal is denied, you typically have the right to external review by an independent third party not affiliated with your insurance company. This is a final appeal option that can overturn insurance company decisions.

External review is available for most employer-sponsored plans and all marketplace plans. The external reviewer’s decision is binding on the insurance company.

What to Do When Coverage Is Denied

Sometimes, despite best efforts, insurance won’t cover Ozempic. Here are your options.

Explore Alternative Medications

If Ozempic is denied but you have diabetes, ask about other GLP-1 medications your plan might cover. Different plans have different preferred medications.

Alternatives to ask about:

- Trulicity (dulaglutide)

- Victoza (liraglutide)

- Rybelsus (oral semaglutide)

- Mounjaro (tirzepatide) if covered for diabetes

Your doctor can help determine if alternatives are appropriate for your situation.

Consider Wegovy for Weight Loss

If you want semaglutide specifically for weight loss (not diabetes), Wegovy is FDA-approved for that indication. Some insurance plans cover Wegovy for obesity treatment when they won’t cover off-label Ozempic use.

Ask your insurance about Wegovy coverage for weight management. The prior authorization process is similar, but because it’s an FDA-approved use, you may have better success.

Use the Ozempic Savings Card

If your insurance covers Ozempic but with high cost-sharing, the Novo Nordisk Savings Card can reduce your out-of-pocket cost to as little as $25 monthly.

The savings card covers up to $150 of your monthly copay or coinsurance. It’s available for commercially insured patients whose plans cover Ozempic. It cannot be used with Medicare, Medicaid, or other government insurance.

Access Cash-Pay Pricing

If insurance won’t cover Ozempic at all, Novo Nordisk’s new cash-pay pricing makes the medication more accessible:

$199 per month: Introductory price for new patients (first two months, available through March 2026) $349 per month: Ongoing price for 0.25mg, 0.5mg, and 1mg doses $499 per month: Price for 2mg dose

This pricing is available through NovoCare Pharmacy and participating retailers like Walmart and Costco. You don’t need insurance approval—just a valid prescription.

Consider Compounded Semaglutide

Compounded semaglutide through TrimRx costs $199 per month, providing the same active ingredient at the lowest available price point. Compounded medications don’t require insurance approval and offer straightforward pricing.

Compounded semaglutide is appropriate when insurance won’t cover brand-name options, when you prefer simpler pricing without programs to navigate, and when cost is a primary concern.

Medicare Coverage Specifics

Medicare has unique rules that affect Ozempic coverage.

What Medicare Part D Covers

Medicare Part D can cover Ozempic when prescribed for type 2 diabetes. Coverage depends on your specific Part D plan’s formulary. Even when covered, you’ll have cost-sharing based on your plan’s structure.

Medicare cannot cover Ozempic when prescribed for weight loss. Federal law (the Medicare Modernization Act) explicitly prohibits Part D from covering medications used for weight loss or anorexia, regardless of medical necessity.

Navigating Part D Coverage for Diabetes

If you have type 2 diabetes and want Medicare to cover Ozempic, check your Part D plan’s formulary for Ozempic, understand the tier and associated cost-sharing, prepare for prior authorization requirements, and expect step therapy requirements (trying metformin first, etc.).

Even when covered, Medicare Part D cost-sharing can be substantial. Under recent legislation, out-of-pocket drug costs are capped annually, which may help with expensive medications.

Medicare Savings Programs

The Ozempic Savings Card cannot be used with Medicare due to federal anti-kickback regulations. Medicare beneficiaries cannot access manufacturer copay assistance.

If your Part D costs are too high, options include switching to a Part D plan with better Ozempic coverage during open enrollment, applying for Medicare Extra Help (Low Income Subsidy) if you qualify, or using cash-pay pricing ($349 monthly) which may be less than your Part D cost-sharing in some cases.

Medicare and Weight Loss

For Medicare beneficiaries wanting semaglutide for weight loss, there is currently no path to Medicare coverage. Your options are cash-pay brand-name at $349 monthly, compounded semaglutide at $199 monthly, or other weight loss approaches that don’t require medication.

Recent policy discussions have addressed potential Medicare coverage for obesity medications, but as of late 2025, the prohibition remains in effect.

Medicaid Coverage Specifics

Medicaid coverage varies significantly by state.

State-by-State Variation

Each state administers its own Medicaid program with different formularies and coverage policies. Some states cover GLP-1 medications like Ozempic for diabetes, while others have more restrictive policies.

As of 2025, most state Medicaid programs cover Ozempic for type 2 diabetes with prior authorization. Coverage for weight loss is available in approximately 14 states, though with strict requirements.

Medicaid Prior Authorization

Medicaid prior authorization requirements are often more stringent than commercial insurance. Expect requirements for confirmed diabetes diagnosis with supporting lab work, documented failure of multiple first-line medications, prescription from specified provider types, regular reauthorization (often every 3-6 months), and ongoing documentation of treatment effectiveness.

Medicaid Limitations

Like Medicare, Medicaid cannot use manufacturer savings programs. The Ozempic Savings Card is not available for Medicaid beneficiaries.

If your state Medicaid denies coverage, options include appealing with additional documentation, requesting a formulary exception, exploring compounded alternatives, or cash-pay pricing if affordable.

Employer-Sponsored Insurance Tips

Many people receive insurance through their employer. Here are strategies specific to employer plans.

Understanding Your Plan

Employer plans vary widely in coverage. Large employers often have more comprehensive formularies, while small employer plans may have more restrictions.

Review your Summary Plan Description (SPD) for detailed coverage information beyond the basic Summary of Benefits.

Working With HR

Your HR department can help clarify coverage questions, explain the appeals process for your specific plan, and potentially advocate for coverage decisions.

Some employers adjust their plans based on employee feedback. If multiple employees need GLP-1 coverage, HR may consider adding or improving coverage during the next plan renewal.

ERISA Protections

Employer-sponsored plans are governed by ERISA (Employee Retirement Income Security Act), which provides specific appeal rights. You’re entitled to a full and fair review of denied claims, specific deadlines for appeal decisions, access to all documents used in the decision, and external review as a final option.

Understanding your ERISA rights helps you navigate appeals effectively.

Timeline: From Prescription to Coverage

Here’s what to expect in terms of timing:

Week 1: Initial Steps

- Doctor writes prescription

- Insurance coverage verified

- Prior authorization submitted (if required)

Weeks 2-3: Waiting for Decision

- Insurance reviews prior authorization

- May request additional information

- Decision typically within 5-15 business days

If Approved:

- Fill prescription with insurance coverage

- Present savings card (if applicable) for reduced copay

- Reauthorization typically needed every 6-12 months

If Denied:

- Receive denial letter (usually within a few days of decision)

- Review denial reason

- Prepare appeal

Weeks 4-6: Appeal Process

- Submit written appeal with additional documentation

- Insurance reviews (typically 30-60 days)

- Decision communicated in writing

If Appeal Denied:

- Request external review (additional 30-60 days)

- External reviewer makes binding decision

Total Timeline:

- Successful first attempt: 2-3 weeks

- Successful on first appeal: 6-8 weeks

- Successful on external review: 10-14 weeks

Frequently Asked Questions

Does insurance cover Ozempic for weight loss?

Insurance rarely covers Ozempic for weight loss because it’s FDA-approved only for type 2 diabetes, not weight management. Most insurance plans explicitly exclude weight loss medications or require a diabetes diagnosis for Ozempic approval. If your doctor prescribes Ozempic off-label for weight loss without a diabetes diagnosis, expect your insurance to deny coverage. Your options in this situation include asking about Wegovy (semaglutide approved for weight loss), which some plans cover for obesity treatment, using the new cash-pay pricing at $349 monthly through NovoCare Pharmacy, or compounded semaglutide at $199 monthly. Some insurance plans do cover weight loss medications under specific circumstances (BMI over 30, or BMI over 27 with comorbidities), but coverage remains uncommon and varies significantly by plan.

What is prior authorization and why is it required for Ozempic?

Prior authorization is a process where your insurance company reviews your prescription to verify it’s medically necessary before agreeing to cover it. For Ozempic, prior authorization is required by most insurance plans because the medication is expensive (approximately $1,000 monthly at list price), alternative treatments exist, and insurance companies want to ensure appropriate use. The process involves your doctor submitting documentation including your diagnosis, lab results, medication history, and explanation of medical necessity. The insurance reviews this against their coverage criteria and approves or denies coverage. Prior authorization typically takes 5-15 business days for standard requests or 24-72 hours for urgent requests. Without prior authorization, your pharmacy claim will be rejected even if your plan covers Ozempic.

How do I appeal an Ozempic insurance denial?

To appeal an Ozempic denial, first review the denial letter to understand the specific reason coverage was denied. Common reasons include incomplete step therapy, insufficient documentation, or clinical criteria not met. Prepare your appeal by directly addressing the denial reason: if step therapy wasn’t completed, document previous medications tried and why they failed; if documentation was insufficient, gather comprehensive lab results and medical records; if clinical criteria weren’t met, provide additional evidence or explain why criteria should be waived. Include a letter of medical necessity from your doctor and relevant clinical research supporting Ozempic for your condition. Submit your written appeal within the deadline (typically 30-180 days) via certified mail. If your internal appeal is denied, you have the right to external review by an independent third party. Many denials are overturned on appeal, especially with thorough documentation.

Can I use the Ozempic savings card with Medicare?

No, Medicare beneficiaries cannot use the Ozempic Savings Card. Federal anti-kickback regulations prohibit pharmaceutical manufacturers from offering copay assistance to patients with government insurance, including Medicare Part D, Medicaid, TRICARE, and VA benefits. If you have Medicare and your Part D plan covers Ozempic for diabetes, you’ll pay whatever cost-sharing your plan requires without manufacturer assistance. If your Part D costs are prohibitive, options include switching to a Part D plan with better Ozempic coverage during open enrollment, applying for Medicare Extra Help (Low Income Subsidy) if you qualify, or using the cash-pay pricing at $349 monthly (paying out of pocket instead of using Medicare). For weight loss specifically, Medicare cannot cover Ozempic regardless of cost assistance, so cash-pay or compounded alternatives are your only options.

What documentation do I need for Ozempic prior authorization?

For successful Ozempic prior authorization, you typically need confirmed type 2 diabetes diagnosis with lab results (HbA1c, fasting glucose), current HbA1c level (many plans require above 7.0% or 7.5%), complete medication history showing previous diabetes treatments tried (especially metformin) and why they were inadequate, documentation of any contraindications to step therapy medications, evidence of diet and exercise attempts, and current weight and BMI. Additional helpful documentation includes specialist letters (especially from endocrinologists), documentation of diabetes complications or cardiovascular disease, and clinical notes explaining why Ozempic specifically is needed. Your doctor’s office handles the actual submission, but you can help by ensuring all relevant medical records are available and asking your doctor to include a detailed letter of medical necessity explaining your specific situation.

How long does Ozempic prior authorization take?

Standard Ozempic prior authorization typically takes 5-15 business days from submission to decision. If your situation is medically urgent, your doctor can request expedited review, which usually results in a decision within 24-72 hours. During the waiting period, you won’t have insurance coverage for the medication. If you need to start treatment immediately, options include paying out of pocket at cash-pay pricing ($349 monthly) while awaiting approval or asking your doctor about medication samples. If you haven’t received a response within the expected timeframe, call your insurance company to check status—sometimes requests get delayed or lost. Once approved, prior authorization is typically valid for 6-12 months before reauthorization is required. Set a reminder to initiate reauthorization before your current approval expires to avoid gaps in coverage.

What if my insurance doesn’t cover Ozempic at all?

If your insurance explicitly doesn’t cover Ozempic (formulary exclusion or weight loss medication exclusion), you have several options. First, ask about formulary alternatives—your plan may cover other GLP-1 medications like Trulicity or Victoza. Second, request a formulary exception, explaining why alternatives aren’t appropriate for your medical situation. Third, if seeking weight loss treatment, ask about Wegovy coverage, which some plans cover when Ozempic isn’t covered. Fourth, use Novo Nordisk’s cash-pay pricing: $199 per month for the first two months, then $349 ongoing (through NovoCare Pharmacy and participating retailers). Fifth, consider compounded semaglutide at $199 monthly through TrimRx, which provides the same active ingredient without insurance involvement. The new cash-pay pricing has made brand-name Ozempic accessible even without insurance, reducing the financial impact of coverage denial from approximately $1,000 monthly to $349.

Does Medicaid cover Ozempic?

Medicaid coverage for Ozempic varies by state. Most state Medicaid programs cover Ozempic for type 2 diabetes with prior authorization, though requirements are often more stringent than commercial insurance. You’ll typically need confirmed diabetes diagnosis with extensive lab documentation, documented failure of multiple first-line medications (step therapy), prescription from specified provider types, and regular reauthorization every 3-6 months. Coverage for weight loss is available in approximately 14 states as of 2025, but with strict requirements. Medicaid beneficiaries cannot use the Ozempic Savings Card due to federal regulations. If your state Medicaid denies coverage, you can appeal with additional documentation, request a formulary exception, or explore cash-pay pricing ($349 monthly) or compounded semaglutide ($199 monthly) as alternatives. Contact your state Medicaid program or check their formulary online to understand specific coverage rules in your state.

Can my doctor help me get Ozempic covered?

Yes, your doctor plays a crucial role in getting Ozempic covered. Your doctor submits the prior authorization request with supporting documentation, writes letters of medical necessity explaining why you need Ozempic specifically, can request peer-to-peer review (speaking directly with the insurance company’s medical director), provides additional documentation for appeals, and can prescribe from a diagnosis that’s more likely to be covered. Work with your doctor by ensuring they have all relevant medical records, asking them to include detailed clinical notes in the prior authorization, requesting they document previous medication failures thoroughly, and asking for a specialist referral (endocrinologist) if that improves coverage chances with your plan. Some doctor’s offices have staff dedicated to insurance authorizations who are experienced in what documentation succeeds with different insurance companies.

How often do I need to reauthorize Ozempic with insurance?

Ozempic prior authorization is typically valid for 6-12 months, depending on your insurance plan. After this period, you’ll need to reauthorize to continue coverage. Reauthorization requirements usually include updated lab results showing current HbA1c, documentation that the medication is working (blood sugar improvement), confirmation you’re still taking the medication as prescribed, and updated clinical notes from recent appointments. Set a reminder 4-6 weeks before your authorization expires to initiate the reauthorization process, avoiding gaps in coverage. Your doctor’s office usually tracks authorization expiration dates and initiates renewal, but following up yourself ensures nothing falls through the cracks. If your health status has changed significantly (better blood sugar control, new complications, etc.), the reauthorization documentation should reflect this. Continued coverage generally requires demonstrating that Ozempic is providing benefit and remains medically necessary.

Making Insurance Coverage Work for You

Getting Ozempic covered by insurance requires understanding your plan’s requirements, providing thorough documentation, and being prepared to advocate for yourself through the appeals process.

For patients with type 2 diabetes, insurance coverage is achievable in most cases with proper prior authorization. The key is working closely with your doctor to document medical necessity, complete any step therapy requirements, and provide comprehensive records supporting your need for Ozempic specifically.

For patients seeking Ozempic for weight loss, insurance coverage is unlikely without a diabetes diagnosis. In these cases, asking about Wegovy coverage (FDA-approved for weight loss), using cash-pay pricing at $349 monthly, or accessing compounded semaglutide at $199 monthly are more practical paths to treatment.

When insurance coverage is obtained, the Ozempic Savings Card can reduce costs to as little as $25 monthly for commercially insured patients, making treatment highly affordable.

When insurance coverage isn’t possible, the new cash-pay pricing has transformed accessibility. What previously cost $1,000 monthly is now available at $349, making brand-name Ozempic financially feasible for many more patients.

Whatever path you take, effective semaglutide treatment is more accessible than ever. Compounded semaglutide at $199 monthly through TrimRx provides the most affordable option for those without insurance coverage. For patients who obtain insurance approval, combining coverage with the savings card minimizes out-of-pocket costs.

Get started with comprehensive medical support, clear guidance on maximizing your results, and access to treatment options that work regardless of your insurance situation. Whether through insurance coverage, cash-pay pricing, or compounded alternatives, the path to effective GLP-1 treatment is available.

Transforming Lives, One Step at a Time

Keep reading

Online Ozempic Prescription Texas

You can get an Ozempic prescription online in Texas through a licensed telehealth provider without an in-person visit. Texas telehealth law allows providers to…

Online Ozempic Prescription California

You can get an Ozempic prescription online in California through a licensed telehealth provider without an in-person visit. California’s telehealth laws allow providers to…

Weight Loss Clinic Online Texas: Your Options

An online weight loss clinic in Texas gives you access to GLP-1 medications like semaglutide and tirzepatide through a fully virtual process. You complete…